Let's see how we can transform your deal!

𝒾Export Marketplace plays a crucial role in negotiating with the exporters and the importers in parallel in order to align their interests and to bridge the gap between both parties towards common business challenges - like:

Thereafter, 𝒾Export Marketplace drafts a contract that accurately reflects the mutually agreed terms and clauses.

As an example, the following solution outlines one such approach is a process which can be operated under our tri-party agreement draft involving

The Exporter (first party).

The Importer (second party).

Third party (reliable and mutually accepted by both parties, such as a bank, an international freight forwarder, or an accredited warehouse).

Under this agreement draft, the contracted goods typically remain in the custody of the third party, until the payment is completed from the second party either through the third party or directly to the first party.

Real Estate Transactions

In the case of real estate transactions, the Buyer, Seller, and the designated trusted third party (who acts as escrow agent) enter into a tri-party agreement that clearly defines the full terms of the sale.

The Buyer deposits either the full payment or an agreed-upon deposit into the escrow account of the designated third party.

The funds remain securely held until the Seller completes the transfer of ownership to the Buyer.

Once ownership is legally confirmed, the third party releases the payment to the Seller.

Jewelry, Antique, or Watch Transactions

For jewelry, antiques, documents, or watches, online transactions often carry risks such as scams, non-delivery, or disputes over product quality. To safeguard both parties, transactions are structured under a tri-party agreement based on our suggested draft. Under this arrangement, responsibility for verifying delivery and the condition of goods lies with a designated third party, mutually trusted by both the Exporter and the Importer, such as a global freight forwarder or an international depository, acting as the escrow agent.

We provide secure depository and safe deposit boxes for precious metals, jewelry, documents, and other valuables. This service allows you to store your assets safely and discreetly, outside the traditional banking sector.

Broker Solutions

Trade Yourself through 𝒾Export Marketplace

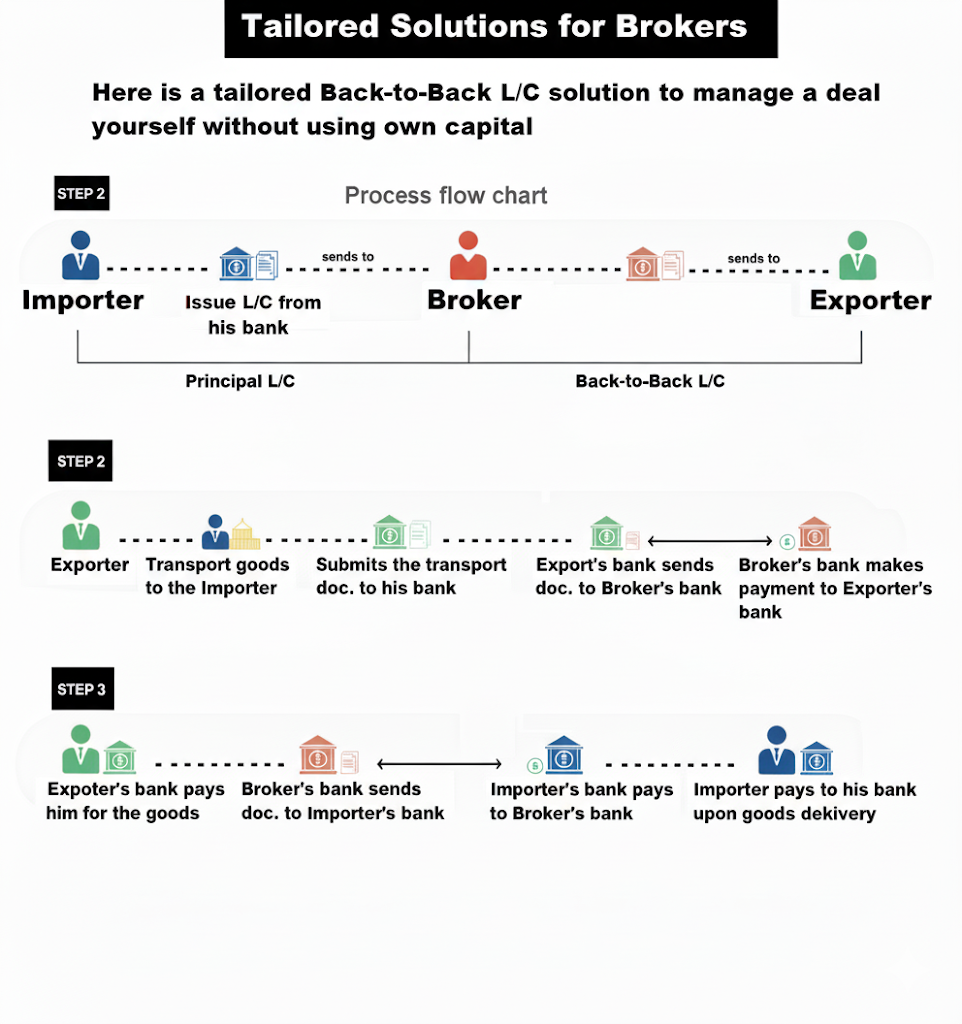

𝒾Export Marketplace tailors different solutions for your different trade issues. As an

example here is a tailored Back-to-Back L/C process helps you to manage international

deals yourself - How it works:

Exporter hands the goods to a mutually accepted shipping company (must be named in the L/C terms).

The shipping company issues a release or receipt document (for example: Bill of Lading, Air Waybill, or Warehouse Release Note).

The Exporter submits this release/shipping document, plus invoice and packing list, to Bank B (the bank that issued the Back-to-Back L/C).

Bank B checks the documents to make sure they match the Back-to-Back L/C conditions.

If documents are correct, Bank B pays the Exporter under the Back-to-Back L/C.

The shipping company then moves the goods to the Importer as arranged under the Master L/C (or releases the goods to the Importer/agent on presentation of the correct documents).

Another suggested process follows these steps:

Our Payment Solution service is available to companies and individuals for specific types of transactions.

FAQ

How do you proceed payment solutions?

First, we identify the core issue: is it a price matter or a process matter?

If it’s a price issue, we provide transparent valuation and flexible payment terms, aiming to bring the exporter’s and importer’s viewpoints closer together.

If it’s a process issue — such as inspection, payment flow, shipping/logistics details, or confidentiality — we redesign the handover into an alternative tri-party/escrow arrangement, ensuring that funds or title are released only once the agreed contractual conditions are met.